If you’re an Israeli company sourcing components, you’re sitting on a goldmine right now—and most of your competitors don’t even know it exists. India’s massive export pivot, triggered by recent US trade tensions, has created unprecedented opportunities for Israeli importers who move fast and position themselves strategically.

As of August 27, 2025, when the US implemented an additional 25% tariff on $60.2 billion worth of Indian exports, everything changed. Indian manufacturers are scrambling to find new markets, and Israeli companies that understand this shift can secure better pricing, more reliable partnerships, and access to high-quality components that were previously locked into US-bound supply chains.

The Perfect Storm Creating Your Opportunity

The numbers tell the story clearly. India is pivoting hard away from US dependency, targeting $100 billion in bilateral trade with Africa by 2025 alone. But here’s what most Israeli importers are missing: this isn’t just about India finding new customers. It’s about Indian manufacturers desperately needing stable, long-term partners who can absorb the production capacity that’s no longer heading to America.

For Israeli component buyers, this translates to unprecedented negotiating power. Indian suppliers who were previously focused on high-volume US contracts are now open to building relationships with smaller, more agile partners. The traditional “minimum order quantity” barriers are crumbling as Indian manufacturers prioritize relationship stability over pure volume.

The pivot is being driven by more than just tariffs. India’s “Atmanirbhar Bharat” (self-reliant India) initiative is pushing manufacturers to develop more diverse, resilient supply chains. They’re investing heavily in technology upgrades, coastal cold-chain facilities, and streamlined regulatory processes—all of which directly benefit Israeli importers looking for higher-quality components with better logistics support.

Key Component Categories Ready for Israeli Partnerships

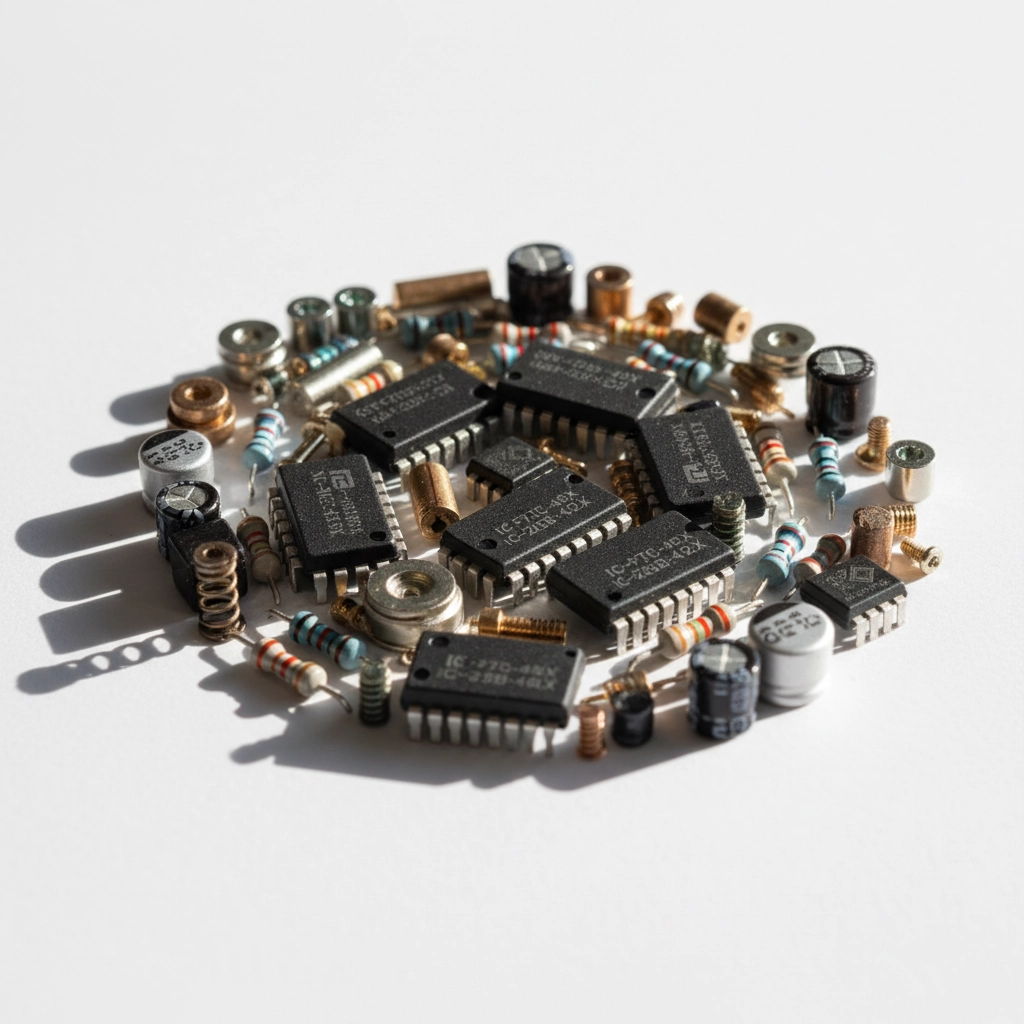

Electronic Components and Semiconductors represent the biggest immediate opportunity. Indian electronics manufacturers, who were heavily focused on US tech supply chains, are now actively seeking new partnerships. Companies in Bangalore, Pune, and Chennai are producing everything from basic resistors to complex integrated circuits, and they’re hungry for stable buyers who can provide predictable demand patterns.

The quality has improved dramatically over the past two years. Major Indian electronics manufacturers have implemented Six Sigma processes and ISO certifications specifically to compete in global markets. For Israeli tech companies needing reliable electronic components at competitive prices, this is the perfect entry point.

Precision Engineering Components offer another goldmine. Indian manufacturers in automotive and aerospace component production have been building capacity for years, initially targeting US automakers. With those relationships now uncertain due to tariffs, companies like Bharat Forge and Sundram Fasteners are actively diversifying their customer base.

Pharmaceutical and Chemical Components present massive opportunities, especially for Israeli biotech and pharmaceutical companies. Indian pharmaceutical exports hit $3.94 billion in 2024-25 for Africa alone, demonstrating the scale of available capacity. Companies like Sun Pharma and Cipla are looking beyond traditional markets and actively seeking partnerships with innovative companies that can provide stable demand.

The regulatory compliance is already there—most major Indian pharmaceutical component manufacturers maintain FDA, EMA, and other international certifications. For Israeli companies, this means access to certified components without the compliance headaches.

How India’s Infrastructure Investments Benefit Israeli Importers

India isn’t just pivoting—it’s upgrading. The $12.37 billion investment surge in international infrastructure means better logistics, more reliable delivery schedules, and improved quality control systems. For Israeli importers, this translates to more predictable supply chains and better component quality.

The establishment of “India+1” export hubs in the UAE is particularly relevant for Israeli companies. These hubs are designed to provide faster, more reliable shipping routes to the Middle East, cutting delivery times and improving supply chain visibility. Israeli importers can now access Indian components with shipping times comparable to European suppliers but at significantly lower costs.

Port Infrastructure Improvements are already showing results. Major Indian ports have invested in automated handling systems, real-time tracking, and dedicated export processing zones. For Israeli companies, this means better visibility into shipment status and more reliable delivery schedules.

Navigating the Geopolitical Advantage

The ongoing Israel-Iran conflict, while creating regional tensions, actually positions Israeli companies favorably in India’s export pivot strategy. India maintains trade relationships across the region but is increasingly looking for stable, reliable partners outside conflict zones.

Indian manufacturers understand that Israeli companies offer technological expertise, innovation capabilities, and market stability that make them ideal long-term partners. Unlike volatile markets, Israeli companies provide predictable demand patterns and are willing to invest in supplier relationships.

The stalled India-Middle East-Europe Economic Corridor (IMEC) due to regional tensions has created openings for direct bilateral trade arrangements. Israeli companies can now negotiate direct partnerships with Indian manufacturers without competing against massive corridor-based trade volumes.

Practical Steps for Israeli Component Buyers

Start with sector-specific trade associations. Organizations like the Confederation of Indian Industry (CII) and the Federation of Indian Chambers of Commerce and Industry (FICCI) are actively promoting diversification partnerships. They’re hosting virtual trade missions specifically designed to connect Indian manufacturers with international buyers.

Focus on tier-2 cities. While everyone focuses on Mumbai and Delhi suppliers, cities like Pune, Coimbatore, and Nashik offer manufacturers with excess capacity, lower labor costs, and more flexible partnership terms. These manufacturers are often more willing to customize products and provide personalized service levels.

Leverage India’s quality certifications. Look for suppliers with ISI marks, BIS certifications, and international quality standards. The Indian government has been pushing quality improvements through various schemes, and certified manufacturers offer reliability comparable to European suppliers at significantly lower costs.

Negotiate long-term partnerships, not just purchase orders. Indian manufacturers are prioritizing relationship stability over short-term profits. Companies that offer multi-year agreements, even with smaller volumes, are getting preferential pricing and priority production slots.

The Technology Transfer Opportunity

Here’s where it gets really interesting for Israeli companies. India’s export pivot isn’t just about moving existing products to new markets—it’s about upgrading capabilities to compete globally. Many Indian manufacturers are actively seeking technology transfer partnerships with innovative companies that can help them upgrade their production capabilities.

For Israeli companies with proprietary processes or technologies, this creates win-win opportunities. You can access lower-cost component manufacturing while helping Indian partners upgrade their capabilities. These partnerships often result in exclusive or preferred supplier relationships that provide long-term competitive advantages.

Acting on the Opportunity

The window for optimal positioning in India’s export pivot is closing fast. As more international companies discover these opportunities, the current favorable terms and eager partnerships will become more competitive. Israeli companies that move now can establish relationships while Indian manufacturers are still prioritizing market diversification over margin optimization.

Start with pilot orders to test quality and reliability, but be prepared to scale quickly if the partnership works. Indian manufacturers are looking for partners who can grow with them as they build their non-US export capabilities.

Focus on components where quality and reliability matter more than absolute lowest cost. Indian manufacturers excel at providing consistent quality at competitive prices, making them ideal for applications where component failure isn’t acceptable but cost control is important.

The current moment represents more than just a sourcing opportunity—it’s a chance to build strategic partnerships with manufacturers who are investing heavily in capabilities and infrastructure. For Israeli companies ready to move beyond traditional European suppliers, India’s export pivot offers the perfect combination of quality, cost-effectiveness, and relationship-focused business practices.

The question isn’t whether you can afford to explore these opportunities. It’s whether you can afford to let your competitors discover them first.